How to Calculate Pip Value in Forex – Easy Guide for Beginners (2025)

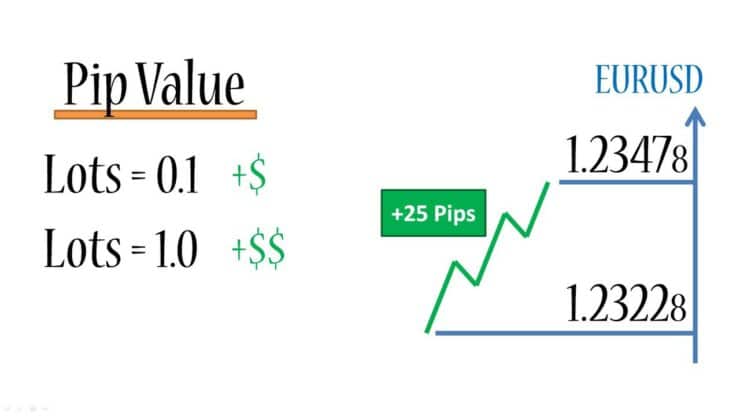

Understanding pip value is crucial in forex trading. A pip (short for “percentage in point”) is the smallest price movement a currency pair can make based on market convention. Knowing how to calculate pip value helps in proper risk management and position sizing.

📘 What is a Pip?

A pip is typically the fourth decimal place in most currency pairs (e.g., EUR/USD). For example, if EUR/USD moves from 1.1000 to 1.1001, that’s a 1 pip move. In JPY pairs, it’s the second decimal.

🧮 Pip Value Formula

Pip Value = (One Pip / Exchange Rate) × Lot Size

For standard lots (100,000 units), 1 pip ≈ $10

For mini lots (10,000 units), 1 pip ≈ $1

For micro lots (1,000 units), 1 pip ≈ $0.10

📊 Example Calculation

Let’s say you trade 1 mini lot (10,000) of EUR/USD:

1 pip = (0.0001 ÷ 1.1000) × 10,000 = $0.91 (approx)

🔍 Why Pip Value Matters

- ✅ Helps calculate potential profit/loss

- ✅ Essential for setting stop-loss and take-profit

- ✅ Crucial for risk management and lot sizing

💼 Best Brokers to Practice Pip Calculations

- 🔹 Exness – Advanced trading tools & calculators 👉 Open Account

- 🔹 XM – Educational materials for beginners 👉 Join XM

- 🔹 JustMarkets – Ideal for small lot trading 👉 Start Now

- 🔹 IUX Markets – Low spreads & micro accounts 👉 Sign Up

- 🔹 Valetax – Beginner-friendly trading dashboard 👉 Try Now

📌 Tags:

pip value calculation, forex pip formula, pip meaning for beginners, micro lot pip value, how to calculate pip mt4, forex risk management, pip value example

New Video Uploaded on YouTube. Like Share And Comment

New Video Uploaded on YouTube. Like Share And Comment