How to Calculate Pips, Lot Size & Risk in Forex – A Beginner’s Guide 2025

New to forex trading? Understanding how pips, lot size, and risk management work is the foundation to avoid blowing your account. This beginner’s guide will simplify everything with examples and formulas.

📌 What is a Pip?

A pip (Percentage in Point) is the smallest price movement in forex. For most currency pairs, 1 pip = 0.0001.

- EUR/USD moves from 1.1000 to 1.1001 = 1 pip

- USD/JPY moves from 110.00 to 110.01 = 1 pip

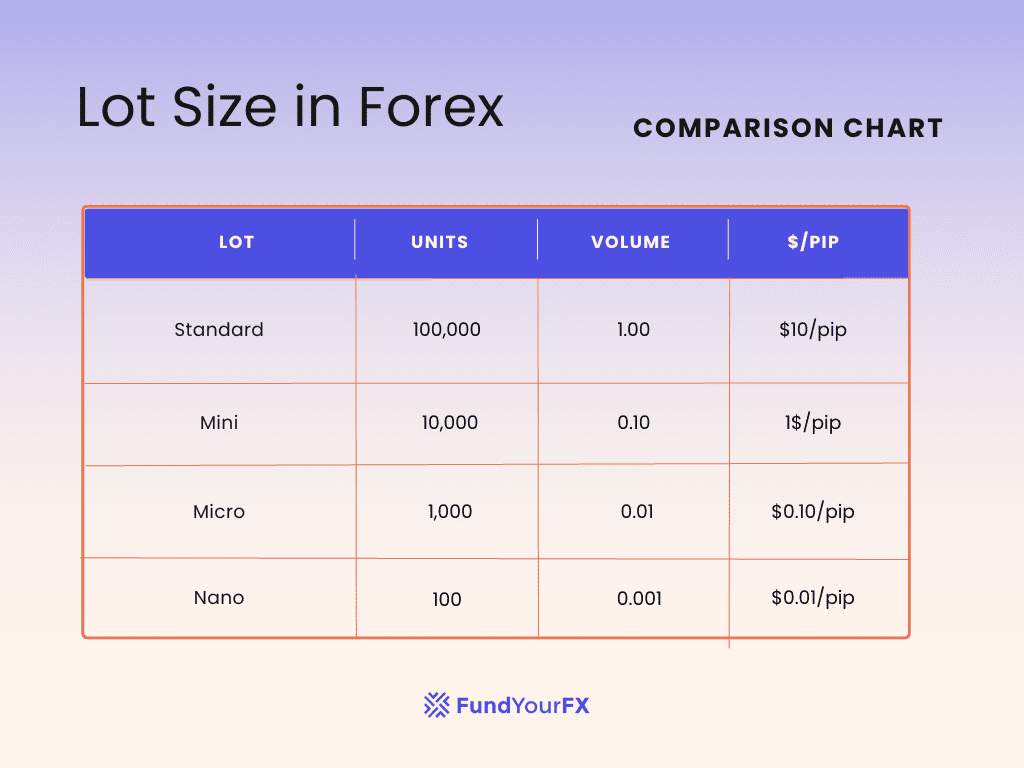

📊 What is Lot Size?

Lot size is the volume you’re trading. It determines the value of each pip movement.

| Lot Size | Units | Value per Pip (USD) |

|---|---|---|

| 1.00 (Standard) | 100,000 | $10 |

| 0.10 (Mini) | 10,000 | $1 |

| 0.01 (Micro) | 1,000 | $0.10 |

📉 Risk Management Formula

Always risk 1–2% of your capital. Use this formula to calculate your lot size:

Lot Size = (Account Risk / Stop Loss in Pips) / Pip Value

Example: If you have $500, want to risk 2% ($10), and stop loss is 20 pips on EUR/USD (pip value $0.10):

Lot Size = 10 / 20 / 0.10 = 0.5 lot

🛠 Tools to Help You

- ✅ Built-in calculator in MetaTrader 4/5

- ✅ Online Pip & Lot Size calculators

- ✅ Risk % calculators (highly recommended)

🚀 Start Practicing with Real Brokers

- 🔹 Exness 👉 Open Account

- 🔹 XM 👉 Open Account

- 🔹 JustMarkets 👉 Open Account

- 🔹 IUX Markets 👉 Open Account

- 🔹 Valetax 👉 Open Account

📌 Tags:

pip calculation, lot size forex, risk management forex, pip value explained, lot size formula, forex trading math, beginner forex calculator

New Video Uploaded on YouTube. Like Share And Comment

New Video Uploaded on YouTube. Like Share And Comment