Forex Strategy

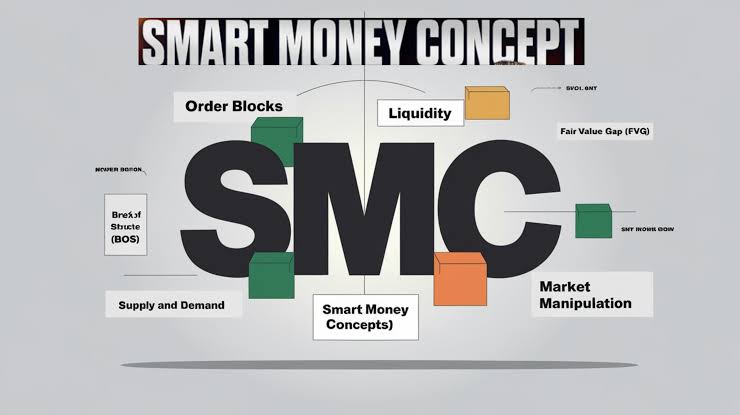

Forex Price Action Playbook: Liquidity, SMC Concepts, and Clean Entries

1) Map Liquidity

- External Liquidity Prior day/week highs and lows, session opens, round numbers (00/50).

- Internal Liquidity Equal highs/lows, small consolidations, wicks.

- Note the draw on liquidity (where price is likely to hunt next).

Goal: Don’t chase. Let price sweep liquidity, then act.

2) Market Structure Shift (MSS)

- Identify the current swing structure on M15/H1.

- Look for a break in structure (BOS) with a strong body close.

- Confirm with displacement (range expansion vs prior bars).

Bias turns only after BOS + displacement.

3) Fair Value Gap (FVG) Entries

- After displacement, mark the 3-candle FVG.

- Place a limit near the 50–66% FVG retrace in direction of the new trend.

- Invalidation: close through the other side of the FVG.

Tip: Align FVG with session killzones (London/NY) for better follow-through.

4) Order Blocks & Invalidations

Use the last opposing candle before displacement as the order block (OB).

- Refine OB on a lower timeframe but keep HTF direction.

- Stop goes beyond OB wick. If price closes beyond, idea is wrong.

5) Risk, Sizing, and Targets

- Risk 0.25–0.75% per trade. Size from stop distance.

- TP1 at equal highs/lows or session high/low; TP2 at external liquidity.

- After TP1, trail with

ATR(3)or last swing.

6) Session Checklist

- Mark HTF liquidity and bias.

- Wait for BOS + displacement.

- Set FVG/OB levels and pre-place orders.

- Manage with partials and strict invalidations.

FAQ

Which pairs?

Majors with tight spreads: EURUSD, GBPUSD, XAUUSD for volatility.

Timeframes?

Bias from H1/H4, entries on M5–M15.