Forex Trader Career Path

Exploring opportunities in the foreign exchange market

What is a Forex Trader?

A Forex trader is a financial professional who specializes in trading currencies on the foreign exchange market. These traders analyze global economic trends, geopolitical events, and market indicators to make informed decisions about buying and selling currency pairs with the goal of generating profits.

Forex traders may work for financial institutions, hedge funds, or trade independently. The forex market operates 24 hours a day during weekdays, requiring traders to often work in shifts or during hours when specific currency pairs are most active.

Key Characteristics of Forex Trading

- Largest financial market with daily trading exceeding $6 trillion

- Operates 24 hours a day, 5 days a week

- Involves trading currency pairs (e.g., EUR/USD, GBP/JPY)

- High liquidity enables rapid execution of trades

- Affected by global economic and political events

Key Responsibilities

Forex traders have a diverse set of responsibilities that require both analytical skills and emotional discipline. Their daily activities typically include:

- Market Analysis: Studying economic indicators, central bank policies, and geopolitical events that affect currency values

- Trade Execution: Buying and selling currency pairs based on analysis and trading strategies

- Risk Management: Implementing strategies to limit potential losses while maximizing gains

- Strategy Development: Creating and testing trading approaches based on technical and fundamental analysis

- Performance Monitoring: Tracking trade results and adjusting strategies as needed

- Staying Informed: Continuously learning about global markets and new trading technologies

Required Skills and Qualifications

Successful Forex traders typically possess a combination of education, skills, and personal attributes:

Education

Most professional Forex traders hold at least a bachelor’s degree in finance, economics, mathematics, or a related field. Many pursue additional certifications such as the CFA (Chartered Financial Analyst) designation to enhance their credentials.

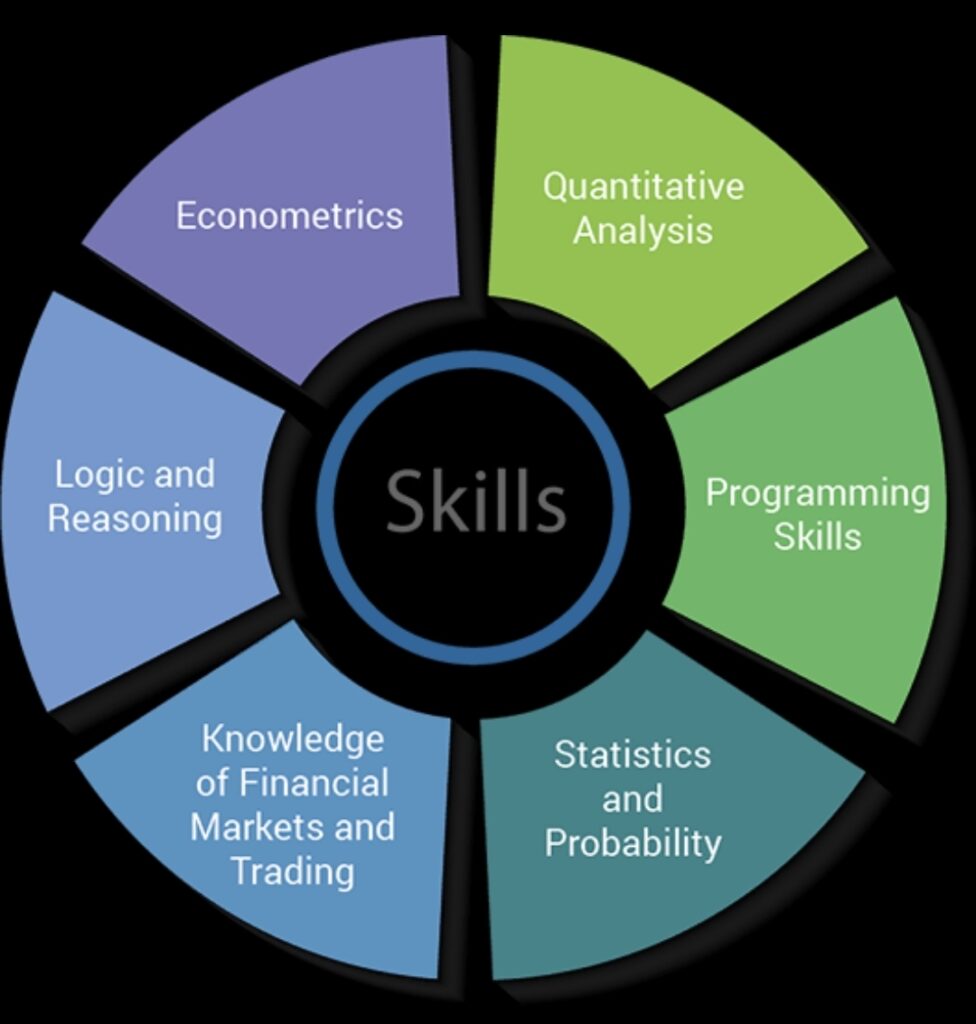

Technical Skills

- Proficiency in technical analysis and chart reading

- Understanding of macroeconomic principles

- Familiarity with trading platforms and analytical software

- Knowledge of risk management techniques

- Statistical analysis and quantitative skills

Personal Attributes

- Emotional discipline and ability to handle stress

- Decisiveness and ability to make quick decisions

- Analytical and problem-solving mindset

- Adaptability to rapidly changing market conditions

- Continuous learning attitude

Career Progression

The career path for a Forex trader typically follows these stages:

- Junior Trader: Entry-level position focusing on learning strategies, assisting senior traders, and managing small positions

- Trader: Responsible for managing larger positions and developing specialized expertise in specific currency pairs

- Senior Trader: Manages significant capital, mentors junior traders, and develops complex trading strategies

- Head of Trading/Portfolio Manager: Oversees a team of traders, allocates capital, and makes strategic decisions

Many experienced traders eventually move into fund management, start their own trading firms, or transition into related fields like risk management or financial analysis.

Challenges and Rewards

Challenges

- High levels of stress due to market volatility

- Need for continuous learning and adaptation

- Potential for significant financial losses

- Irregular working hours, especially when trading international markets

- Emotional discipline required to avoid impulsive decisions

Rewards

- Potential for high earnings, especially for successful traders

- Intellectual challenge of analyzing complex global markets

- Opportunity to work in a fast-paced, dynamic environment

- Flexibility to work from various locations

- Clear performance metrics based on trading results

Getting Started in Forex Trading

For those interested in pursuing a career in Forex trading, consider these steps:

- Obtain a relevant degree in finance, economics, or a related field

- Gain a solid understanding of macroeconomic principles

- Practice with demo accounts to develop trading skills without risk

- Consider internships at financial institutions or trading firms

- Network with professionals in the industry

- Pursue relevant certifications such as the CFA designation

- Start with personal trading to build a track record

Important Considerations

Forex trading carries significant risk of loss and is not suitable for all investors. Before pursuing this career path, honestly assess your risk tolerance, emotional resilience, and interest in global markets. Success requires continuous education, discipline, and the ability to learn from both successes and failures.