Lot Size in Forex Explained – How to Calculate & Manage Risk in 2025

Lot size is one of the most important yet misunderstood aspects of forex trading. Simply put, it determines how much currency you’re buying or selling. Choosing the right lot size helps you manage risk effectively and protect your trading capital.

🔍 What is Lot Size in Forex?

- Standard Lot: 100,000 units = $10 per pip

- Mini Lot: 10,000 units = $1 per pip

- Micro Lot: 1,000 units = $0.10 per pip

- Nano Lot: 100 units = $0.01 per pip

🧮 How to Calculate Lot Size

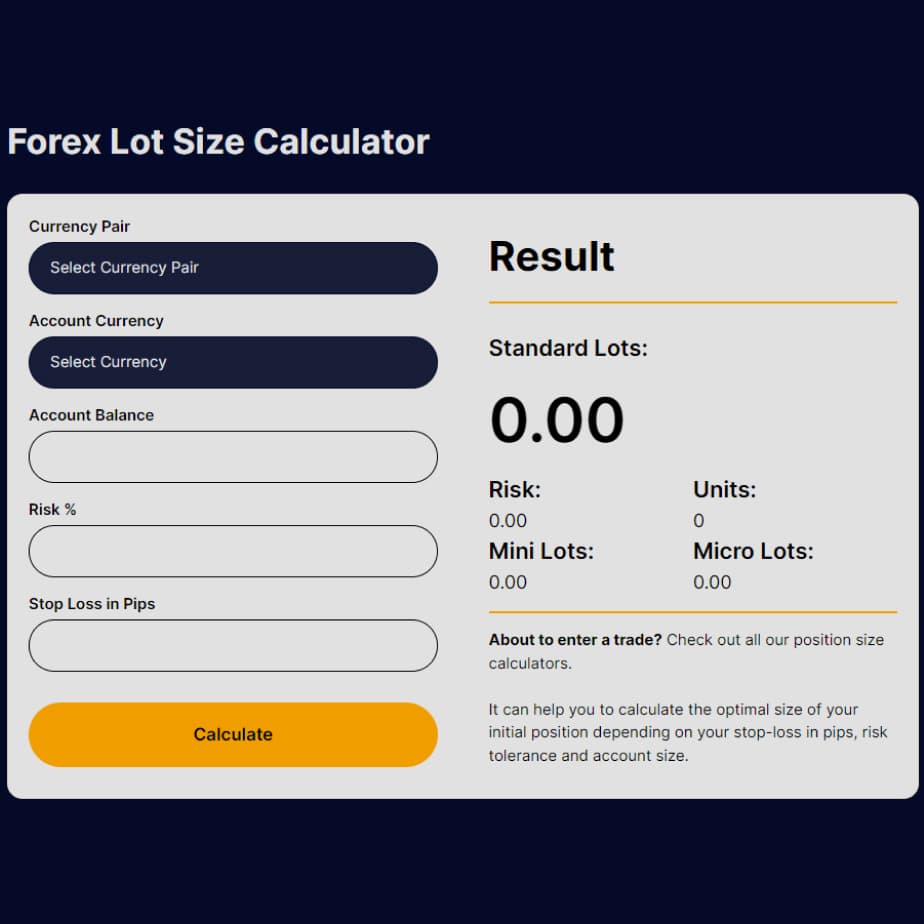

Use this formula to calculate your ideal lot size based on your risk:

Lot Size = (Account Balance × Risk %) / (Stop Loss in Pips × Pip Value)

Example: If you have a $1,000 account, risk 2%, and use a 50-pip stop loss:

Lot Size = (1000 × 0.02) / (50 × 0.10) = 0.4 lots

💡 Best Practices for Lot Sizing

- ✅ Risk only 1–2% of your account per trade

- ✅ Use a reliable lot size calculator (many brokers provide this tool)

- ✅ Adjust lot size according to market volatility

- ✅ Stay consistent – avoid changing lot sizes impulsively

📊 Why Lot Size Matters for Your Strategy

Choosing an incorrect lot size can lead to overexposure or very slow growth. Mastering lot sizing is essential for sustainable trading and long-term profitability.

🚀 Trade with Brokers That Offer Flexible Lot Sizes

- 🔹 Exness 👉 Open Account

- 🔹 XM 👉 Open Account

- 🔹 JustMarkets 👉 Open Account

- 🔹 IUX Markets 👉 Open Account

- 🔹 Valetax 👉 Open Account

📌 Tags:

forex lot size calculator, how to calculate lot size, forex risk management, pip value explained, beginner forex guide 2025, lot size trading strategy, money management in forex